From Barter to Bitcoin: The History and Evolution of Money in Nigeria

When one thinks of money, it is easy to think that it has always been around. That is right in a sense, but only to the extent that humans have had a system of exchange for centuries. However, the concept of money, particularly in the form most obtainable in nearly all countries of the world, being the coin or paper representation of same, is relatively recent. That is, its origins can be traced back to the time Before Common Era.

The Definition of Money

Money has been described in a number of ways including as a “medium of exchange that is generally accepted as payment for goods and services,”[1] and/or a “measure of value.”[2] It is generally agreed that money ought to be interchangeable, durable, divisible, portable, acceptable, and scarce.[3]

Just like with biological evolution, one can picture the upward metamorphosis of the trade by barter (or bartering) system, which is (one of) the earliest known means of exchange amongst the more primitive of our predecessors. Its phenomenal development into what is now the complexity of varying occurences of money, including digital currencies that are sometimes represented by numbers stored in databases or blockchains, is both fascinating and innnovative.

There are those who argue that money is not real, given the fact that its worth is arbitrarily determined, and its value is not inherent like with precious stones and other physical objects which are valued for their usefulness, scarcity or other such parameters. Whatever one’s opinion, it can be said that money is valuable as long as it is socially and collectively agreed as such.

Before Money

The early man was of course, a hunter-gatherer, content in his little cave and utterly self-reliant. But as communities grew and expanded, people discovered and/or developed new skills. Say one man was great at making tools from trees struck down by lightning, and another had some inexplicable ability to grow the best crop even in the most adverse weather, the farmer could exchange some of his harvest for the forger’s tools. One cannot help but wonder how the worth of each man’s resource was scaled against the other. We can hazard a guess that there were no fixed “prices” for anything and that any such exchange of goods and/or services were solely at the agreement of both parties.

Bartering (plantains for fish, AI)

Bartering (plantains for fish, AI)

Bartering still exists today and is just as unregulated as it has been since those early times. The use of bartering is efficient in niche markets where the key players can both benefit each other through their specialised offerings. It is safe to say trade by barter has been around for thousands of years and it is likely to be for even longer years to come.

However, the bartering system was clearly rife with certain inadequacies, particularly with more and more people exploring settlements beyond theirs through the advent of trading and travelling. One such problem being the issue of mobility. Given that barter trading sometimes involved huge and cumbersome loads of physical objects, including livestock and perishable farm produce, it was exerting to lug around enormous cumbersome journeys.

Commodity Money

The inadequacies of the bartering system obviously led to the need to seek better ways of doing business. One such manner of trading retained the semblance of the barter system as people continued to trade things for things. It is common knowledge that humans across history have affixed value to certain objects whether as a result of their rarity or long-lasting qualities. It only follows that some things became attributed with the power of exchange.

Cowries (antique collection, both sides)

Cowries (antique collection, both sides)

These are what became known as commodity money and included things such as dried corn, animal skin pelts, salt, cowries, and precious metals such as gold, bronze and silver. One may argue that commmodity money is not just an offshoot of bartering, but in fact, a form of same. The major difference being that the scope of what was acceptable as exchange in bartering was now more limited to the objects recognised as commodity money.

Fiat Money

Certainly, commodity money had its own shortfalls and given the said shortcomings of the commodities used as means of exchange, advanced societies founded a system in which some body of a country’s governance was tasked with the duty to populate the economy with legal tender in varying forms. The earliest forms of currency were the coin and eventually paper money, both generally believed to have originated in China at different points in time. The burst in global integration of services, businesses and even politics has made it such that, like with most other things, money can now be electronically represented and accessed, in addition to its already being physical. Various societies have embraced the seamlessness of transacting with digital currencies or digital (and usually regulated) representations of fiat money, amongst other virtual representations of money around the world.

Stocks and bonds are also forms of fiat money. They are not physical representations of money but are rather, representations of the value of a company or government. They are also regulated by the government and are usually traded on the stock market.

The Many Faces of Money in Nigeria

Nigeria, Africa’s most populous country, shares this experience with the rest of the world, of course. The evolution of the Nigerian currency ties in well with the concepts of bartering, commodity and fiat money. In order to arrive at the focal point herein, a detour towards the banks of history is of the essence.

Barter Trade

In the days before the colonies fell to British rule, indigenous people of various tribes in what now forms the Federal Republic of Nigeria, affectionately dubbed “Naija” by her (mostly) youthful and energetic populace, conducted their trade through the use of bartering. Trade routes along the notable rivers Benue and Niger encouraged riverine commerce. These traders travelled through smaller creeks to and around villages in the delta order to engage in barter transactions with the other tribes using items such as salt and fish in exchange for vegetables and tools.[5]

The Manilla

Manillas (National Museum of African American History and Culture)

Manillas (National Museum of African American History and Culture)

The arrival of the Portuguese on the shores of precolonial Nigeria in the sixteenth (16th) century heralded a boom in international trade as well as a voyage into the use of commodity money such as Manillas, a bronze or copper amulet crafted in the shape of a horseshoe, and which served as a means of exchange across West Africa[4] and were first introduced on the coasts of South-Eastern Nigeria in the city of Calabar (the capital of Cross River State). The manilla was also called Òkpòhò by the Efik and Ibibio people of the region.

By virtue of the Native Currency Proclamation of 1902, Manillas were prohibited from being imported without the High Commissioner’s go ahead, nevertheless, they did not completely cease to be legal tender until 1949 following a six-month active effort by the government of the day to withdraw them from circulation. Cowries still featured in this era but were only worth a smaller fraction of the more widely recognised and regarded Manilla.

Exposed to the many possibilities on this side of the African continent through the activities of the Portuguese, the British took a great interest in the settlements of different tribes of over two hundred and fifty (250) ethnicities. This interest by the British is possibly the most well-known fact about Nigeria.

The Pound, The Shilling and The Pence

It took the abolition of the slave trade which had displaced millions of tribespeople between 1600 to 1800 to cause the British to step in fully by way of an ostensible intervention and furthermore, through the instrumentality of the Niger Royal Company Territories and the Southern Protectorate, British interests gained further ground and advanced to the point where Lagos was annexed as a British Colony through the Treaty of Cession signed on 6 August 1861.

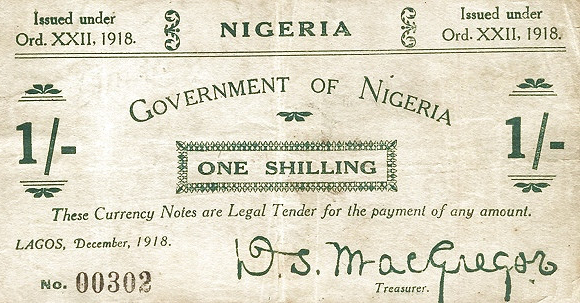

1 Nigerian Shilling (note)

1 Nigerian Shilling (note)

In the furtherance of this objective, the Shilling and Pence were introduced in 1880. Forty years on, the legitimacy of British rule continued to spread and through the infamous Berlin Treaty of 1885, huge exports were procured for the British government and its people. The Northern colony/protectorate supplied groundnuts while the West and Niger Delta had the responsibility of bringing in rubber, cotton and cocoa and palm oil respectively.

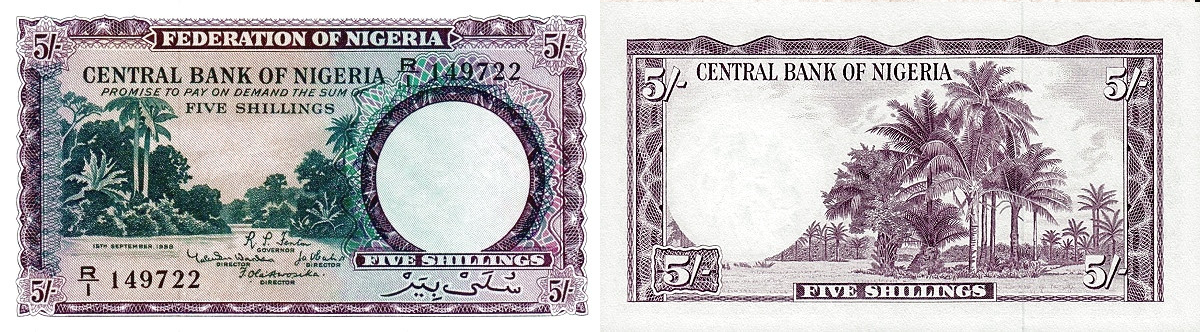

5 Nigerian Shillings (note)

5 Nigerian Shillings (note)

Frederick Lugard (whose eventual bride has also been historically fingered as being responsible for the coinage of the term “Nigeria” in a January 8, 1897 article for The Times of London) took over the Northern frontiers and unified them in what became known as the amalgamation of 1914. At this point, the West African Currency Board had introduced the Nigerian Pound.

5 Nigerian Pounds (note)

5 Nigerian Pounds (note)

Having become an absolute venture of the British government subject in its entirety to the Queen’s rule, it was only natural that the means of exchange became unified as well. Consequently, the British currency was adopted as the official currency of the Nigerian Colony.[6]

Enter CBN, Enter Naira

The Nigerian Pound enjoyed undisturbed valuable status from 1912 until about fifty (50) years ago in January 1, 1973, when the Naira (₦) was brought into existence by the Central Bank of Nigeria (CBN). Adopting a decimal system, part of the new currency was a smaller denomination known as the Kobo (K).

10 Nigerian Kobo (coin)

10 Nigerian Kobo (coin)

50 Nigerian Kobo (note)

50 Nigerian Kobo (note)

In the fifty years since, the Naira has undergone many changes including, notably, the release of new denominations, from ₦1 to the extant ₦1,000, which is presently the country’s highest currency denomination. Presently in circulation are the ₦1,000, ₦500, ₦200, ₦100, ₦50, ₦20, ₦10 and ₦5 notes, as well as the ₦2, ₦1 and 50K coins, though the latter are quite rare, most likely due to their insignificant value in the present inflationary economy.

In the years following, the Naira’s form has continued to evolve with significant introductions and redesigns. On February 28, 2007, a polymer variant of the ₦20 note was issued. Concurrently, the ₦50, ₦10 and ₦5 notes were reissued with new designs alongside the introduction of the ₦2 coin, and the ₦1 and 50K coins saw redesigns as well. On September 30, 2009, the redesigned ₦50, ₦10 and ₦5 notes transitioned to the polymer substrate, consolidating lower denominations into this new material. Commemorative ₦50 and ₦100 notes were issued in celebration of Nigeria’s 50th and 100th Independence anniversaries on September 29, 2010, December 19, 2014 respectively.

Naira in the Digital Era

The journey from bartering to commodity money to coins and paper fiat money is fascinating but Nigeria, for all her shortcomings, dares to innovate and move with the times in some regard. This is evidenced by the introduction of the eNaira by the CBN in 2021. The eNaira is “both a medium of exchange and a store of value” and is equivalent to a physical paper (or polymer, as the case may be) version of the Naira.

50 Nigerian Naira (note)

50 Nigerian Naira (note)

50 Nigerian Naira (polymer note)

50 Nigerian Naira (polymer note)

Although Nigeria’s eNaira holds the distinction of being Africa’s first Central Bank Digital Currency (CBDC), the platform needs significant improvements to achieve the widespread adoption for which it has been designed. Per the standards of traditional banking in Nigerian, the eNaira Android and iOS apps could use a user interface (UI) and user experience (UX) overhaul. Numerous bug fixes are anticipated by early adopters. Presently, feature-wise, the eNaira does not offer much more than the existing mobile/web banking, electronic transfers and physical customer care/support of the various banks in Nigeria. However, if the CBN and eNaira developers address the software defects and polish the experience, it could become viable.

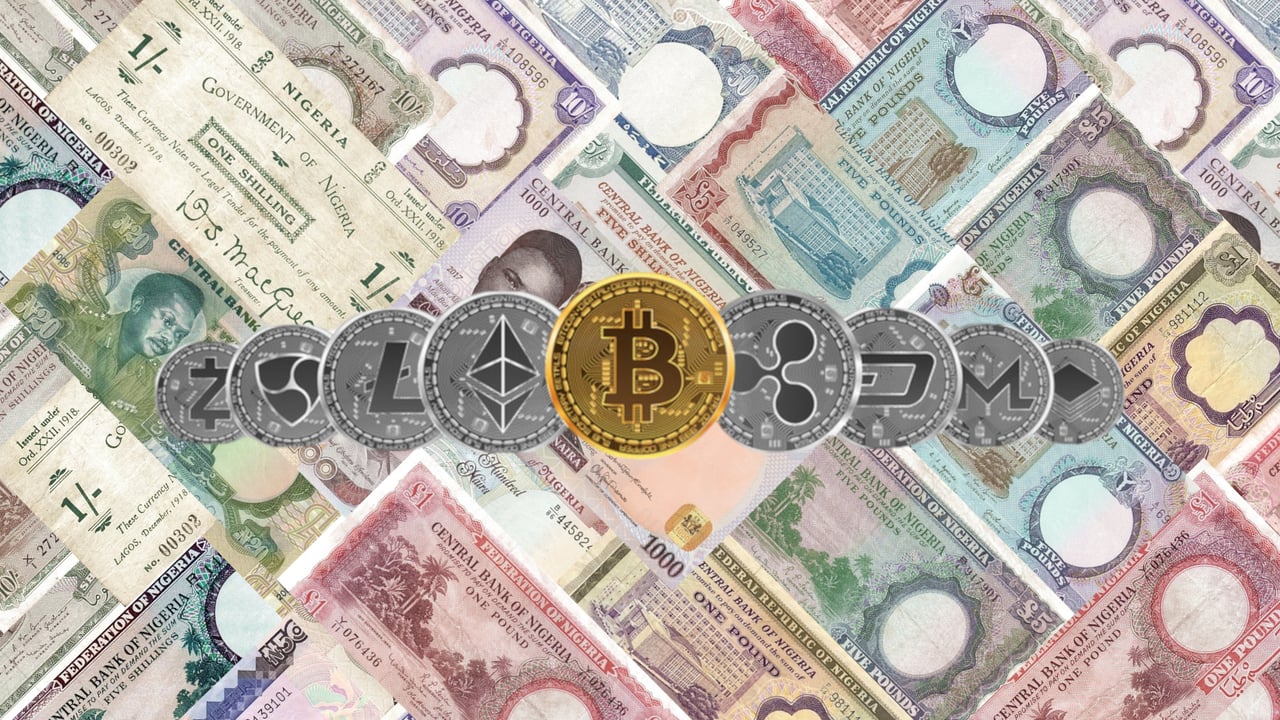

Cryptocurrency: The Magic Money

Cryptocurrencies are digital currencies built on blockchains - distributed ledgers secured by cryptography. Wallets are software that store public/private keys and enable sending/receiving coins. Exchanges facilitate buying and selling. Unlike fiat currencies, cryptocurrencies are unregulated at birth, though governments can later regulate them. Most major cryptocurrencies like Bitcoin aren’t backed by physical assets, though stablecoins aim to be backed by fiat reserves. Values are speculative, driven by supply/demand.

There are several methods to acquire cryptocurrencies. The most common is to purchase them on an online exchange platform and then transfer them into a digital wallet under your control. They can also be earned through activities like mining, staking, or promotional airdrops. To spend cryptocurrencies, one initiates a transaction to send coins from their wallet to the recipient’s wallet address. On the flip side, to receive cryptocurrencies, one provides the sender with a wallet address to deposit the coins into. Overall, cryptocurrency transactions involve transferring digital tokens between parties without needing a central intermediary.

Blockchain explorers are supplementary tools that help visualize blockchain contents. Like search engines, they enable looking up transactions, addresses, and blocks on a blockchain. Explorers make the data on public blockchains transparent and accessible.

Bitcoin

Bitcoin (BTC) was the first cryptocurrency, created in 2009 by the anonymous Satoshi Nakamoto. It remains the most popular and valuable cryptocurrency. It simply came into existence and grew in value over time.

One bitcoin, divisible to 8 decimals, is worth approximately thirty-five thousand USD ($35,000) in November, 2023. Its all-time high (ATH) valuation was over sixty-nine thousand USD ($69,000) in November 10, 2021. Bitcoin is now seen as an investment asset and a potential store of value or “digital gold” by some. Cryptocurrencies created after Bitcoin are known as altcoins.

Altcoins

Other major cryptocurrencies include Ether (ETH), Ripple (XRP), and Binance Coin (BNB). Additionally, some cryptocurrencies use smart contracts to enable utility and security functions.

Stablecoins form another class of cryptocurrencies designed to minimize volatility. Their values are pegged to fiat currencies like the US Dollar. For example, Tether (USDT) claims to be backed by USD reserves, however, stablecoins carry risks - high demand can break the intended 1:1 peg, and reserves allegedly backing coins like USDT have been questioned.

Crypto Economy in Nigeria

Cryptocurrency adoption is growing rapidly in Nigeria. From July 2022 to June 2023, over fifty billion USD ($50,000,000,000) worth of cryptocurrencies were traded by Nigerians on public blockchains. In response, the CBN launched the eNaira - a digital currency backed by the government, where transactions are said to be recorded on a private blockchain. However, the eNaira is not a cryptocurrency. It is a digital representation of the Naira, regulated by the CBN.

Regulating digital assets has been a rollercoaster ride for Nigeria. Key events include:

- February 5,2021: CBN directs banks to close accounts of persons or entities involved in cryptocurrency transactions within their systems.

- February 11, 2021: The senate invites the CBN, the Securities and Exchange Commission (SEC) to discuss the effects of cryptocurrencies on Nigeria’s economy and security.

- February 22, 2021: The SEC concludes there is a need to regulate cryptocurrencies.

- February 26, 2021: Yemi Osinbajo, Vice President of Nigeria, calls for a regulatory framework for cryptocurrencies rather than an outright ban.

- March 21, 2021: The CBN clarifies its position on the ban and states that individuals are not prohibited from buying and trading crypto, just not through any Nigerian bank or fintech.

- October 25, 2021: Nigeria launches the eNaira.

- May 15, 2022: The SEC recognises digital assets as securities and issues regulations on exchange and custody of cryptocurrencies in the country.

- May 28, 2023: President Muhammadu Buhari signs the 2023 finance bill into law. The act introduces a ten percent (10%) taxation of gains on the disposal of digital assets including cryptocurrency. The act became effective on the first day of May, 2023.

While not legal tender, cryptocurrencies aren’t illegal in Nigeria either. Adoption is growing annually. The government is taking steps toward regulation, suggesting cryptocurrencies may play a greater economic role going forward.

Fun Facts / Summary

There are two valid versions of the One Hundred Naira note in concurrent circulation. The older note was issued in 1999 while the newer, redesigned version was released in 2014 on the commemoration of Nigeria’s Amalgamation a hundred years before.

100 Nigerian Naira note versions: 1999 (left) and 2014 (right)

100 Nigerian Naira note versions: 1999 (left) and 2014 (right)

Other facts about the Nigerian currency:

- The Nigerian Naira (symbolized by the ₦ sign, Unicode: U+20A6) was introduced on 1 January 1973, replacing the pound at a rate of two 2 Naira = 1 Pound.

- The name “Naira” was coined from the word “Nigeria” by Obafemi Awolowo and launched as currency by Shehu Shagari as Minister of Finance in 1973.

- The Naira is subdivided into one hundred (100) smaller units known as Kobo.

- The Nigerian Pound (symbolized by the £ sign) was used in Nigeria from 1907 to 1973. Each could be divided into twenty (20) Shillings or two hundred and forty (240) Pence. The Nigerian Shilling was divided into twelve (12) Pence.

- The 1000 Naira note, introduced on October 12, 2005, is the highest denomination and features the portraits of Alhaji Aliyu Mai-Bornu and Dr. Clement Isong, former governors of the Central Bank of Nigeria.

- The Central Bank of Nigeria (CBN) is the sole issuer of legal tender money throughout the Nigerian Federation.

- The ISO 4217 (currency code) for the Nigerian Naira is NGN.